Understanding the 2025 Social Security COLA Increase

The 2025 Social Security Cost of Living Adjustment (COLA) is a significant factor for millions of Americans relying on Social Security benefits. This increase aims to protect the purchasing power of benefits against rising inflation and the increasing cost of living.

Factors Influencing the COLA Increase

The COLA increase is calculated annually to ensure Social Security benefits keep pace with inflation. This calculation is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the prices of goods and services commonly purchased by urban wage earners and clerical workers. The CPI-W is a key indicator of inflation and is used to adjust various economic indicators, including Social Security benefits.

Projected COLA Increase for 2025

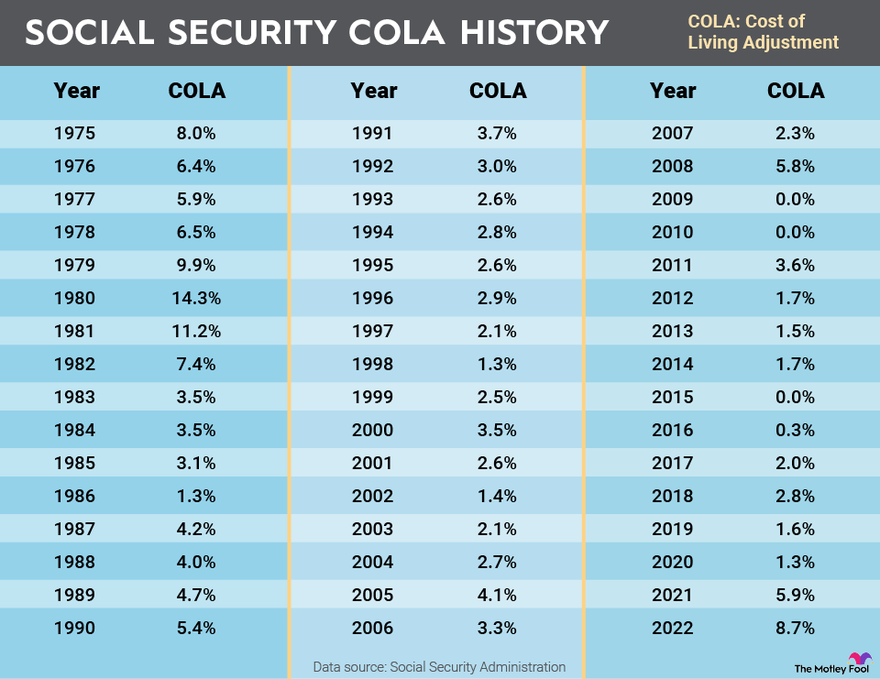

The projected COLA increase for 2025 is expected to be around 3.3%. This estimate is based on the average annual increase in the CPI-W from the third quarter of 2023 to the third quarter of 2024. This projected increase is significantly lower than the 8.7% increase in 2023, which was the highest in decades.

Comparison to Previous Years’ Increases

The 2025 COLA increase is a significant topic of discussion as it follows a period of high inflation and a large COLA increase in 2023. Comparing the projected 2025 increase to previous years highlights the impact of inflation on Social Security benefits.

- The 2023 COLA increase was 8.7%, the highest in decades, reflecting the high inflation experienced in 2022.

- The 2022 COLA increase was 5.9%, a significant increase compared to the 1.4% increase in 2021.

- The 2020 COLA increase was 1.6%, a modest increase reflecting the low inflation experienced in 2019.

The comparison of these COLA increases highlights the fluctuating nature of inflation and its impact on the purchasing power of Social Security benefits.

Impact of the COLA Increase on Beneficiaries: 2025 Social Security Cola Increase

The 2025 Social Security COLA increase, while designed to help beneficiaries keep pace with inflation, has a varied impact on their purchasing power and financial well-being. Understanding how this increase affects different categories of beneficiaries is crucial for assessing its overall effectiveness.

Impact on Purchasing Power, 2025 social security cola increase

The COLA increase aims to maintain the real value of Social Security benefits by adjusting them for inflation. This means that beneficiaries should be able to purchase the same goods and services with their benefits after the increase as they could before. However, the actual impact on purchasing power can vary depending on individual circumstances and spending patterns.

For example, if the cost of food and healthcare increases at a faster rate than the overall inflation rate, beneficiaries may find that their purchasing power for these essential items has declined, even after the COLA increase.

Impact on Different Categories of Beneficiaries

The impact of the COLA increase can differ significantly across various categories of beneficiaries:

Retirees

For retirees, the COLA increase provides a much-needed boost to their income, helping them maintain their standard of living in the face of rising prices. However, the increase may not be enough to fully offset inflation for some retirees, especially those with limited savings or other sources of income.

Disabled Individuals

The COLA increase can be particularly impactful for disabled individuals, who often face higher healthcare costs and may have limited employment opportunities. The increase can help them cover essential expenses and improve their overall financial security.

Survivors

Survivors, who rely on Social Security benefits to support themselves and their families, also benefit from the COLA increase. This increase can help them maintain their financial stability and meet their household needs, especially in cases where the deceased breadwinner was the primary source of income.

Implications for Beneficiaries’ Financial Well-being

The COLA increase can have significant implications for the financial well-being of beneficiaries. For some, the increase may provide a much-needed cushion against rising costs and allow them to maintain their standard of living. However, for others, the increase may not be enough to cover all their expenses, particularly those with limited savings or other sources of income.

The COLA increase can also have an impact on beneficiaries’ ability to save for the future. For those who are able to save, the increase may provide them with additional funds to invest or put aside for retirement. However, for those who are struggling to make ends meet, the increase may not be enough to allow them to save.

Economic and Social Implications of the COLA Increase

The 2025 Social Security COLA increase, while designed to help beneficiaries maintain their purchasing power, has broader economic and social implications that ripple through the economy. This increase affects consumer spending, economic growth, and even the sustainability of the Social Security program itself.

Impact on Consumer Spending and Economic Growth

The increase in Social Security benefits directly translates into higher disposable income for millions of Americans. This additional income is likely to be spent on essential goods and services, stimulating consumer demand and contributing to economic growth.

The impact of the COLA increase on consumer spending is expected to be significant, particularly in sectors like healthcare, food, and housing, which are heavily relied upon by seniors.

- Increased Spending: The COLA increase puts more money in the hands of seniors, who tend to have a higher propensity to spend than other demographics. This increased spending will boost demand in various sectors, potentially leading to job creation and business growth.

- Economic Multiplier Effect: The increase in spending by seniors creates a ripple effect throughout the economy. Businesses that benefit from this increased demand may hire more employees, invest in expansion, and further stimulate economic activity.

- Inflationary Pressures: While the COLA increase aims to protect purchasing power, it can also contribute to inflationary pressures. Increased demand, coupled with supply chain constraints, could lead to higher prices for goods and services, potentially offsetting the benefits of the COLA increase.

Challenges and Opportunities for the Social Security Program

The COLA increase, while beneficial for beneficiaries, also presents challenges for the long-term sustainability of the Social Security program.

- Increased Outlays: The COLA increase significantly raises the annual outlays of the Social Security program, putting further pressure on its trust fund. This requires careful consideration of long-term funding strategies to ensure the program’s solvency.

- Potential for Program Reform: The rising costs associated with the COLA increase may necessitate policy changes to ensure the long-term viability of the Social Security program. This could involve raising the retirement age, adjusting benefit formulas, or increasing payroll taxes.

- Political and Social Considerations: Any proposed reforms to the Social Security program are likely to face political and social opposition. Finding a balance between ensuring the program’s long-term sustainability and protecting the benefits of current and future retirees will be a major challenge.